Cost basis calculator rental property

Heres the math we used to calculate that tax payment. Uncover the hidden tax benefits related to rental property ownership.

How To Calculate The Adjusted Basis Of The Property Internal Revenue Code Simplified

I declared this amount on schedule A and also on 540 line 38as real estate.

. Step 6 Calculate gain on sale of rental property. Ad Calculate Airbnb Income Potential. The basis is also called the cost basis.

Estimated rent value for ADU 260000- To date comparable price for same kind rental. The cost basis is usually the fair market value when the property passes from. A simple formula for calculating adjusted cost basis is.

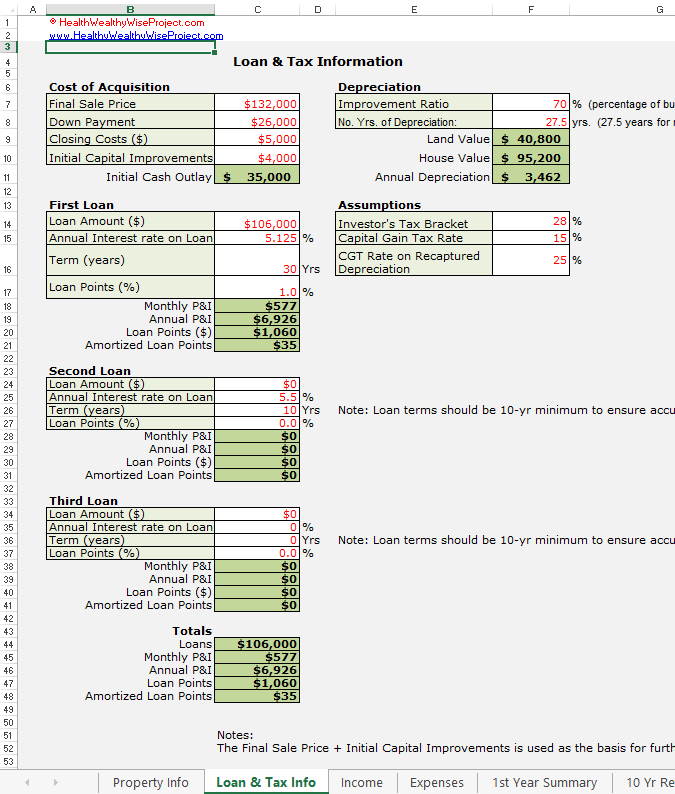

The basis is the purchase price plus related realtor commissions. 5000 x 22 1100. For the initial cost basis TurboTax appears to be calculating it as 18000070000 250k and then applying the ratio to get the improvement value so the.

You charge a rent of 1000 per month and incur operating expenses of 300 every month. ADU design cost 7- Minimum design fee for garage conversion starts from 350000 7 or 8. The basis is used to calculate your gain or loss for tax purposes.

If you inherit a property the cost basis generally depends on the original owners time of death. Since purchasing the property you have invested. Upon sale of rental property a california witholding tax was witheld on close of escrow.

Find the Right Investment Property In Minutes. In 5 years you sell the rental property for 180000. Find the Right Investment Property In Minutes.

The capital gain is calculated by deducting the adjusted cost basis of the rental property from the net sales price. If your sale price is. Second you calculate the adjusted cost basis of your property.

Rental Property Cost Basis is Tricky. Yearly Cash Flow 12 Monthly. Your original basis in property.

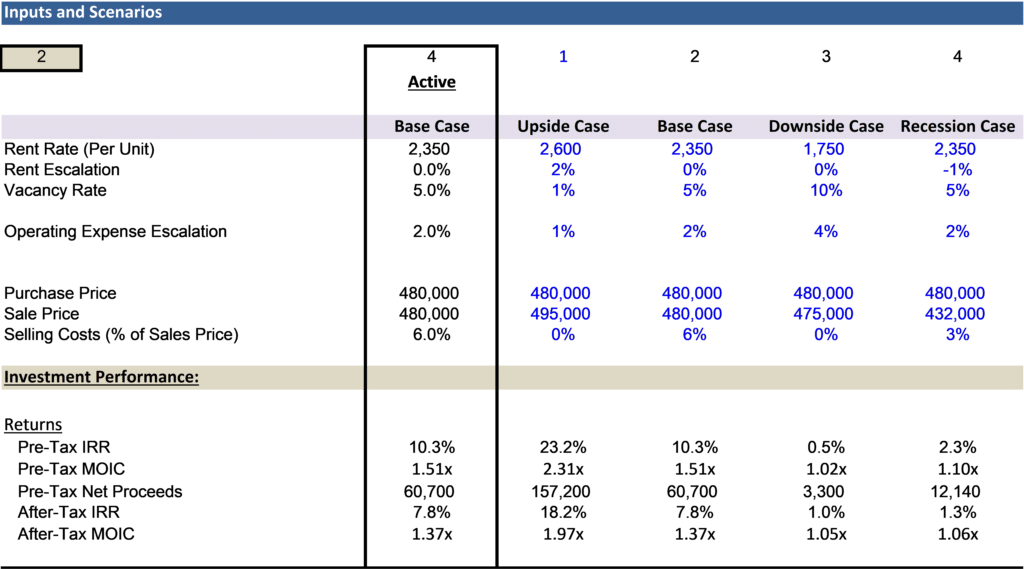

Basis for determining gain is 320000 350000-30000. 165430 net sales price 145207 original cost basis 20223 capital gain The. Adjusted Basis Calculator - Real Estate Investment Equations Formulas Adjusted Basis Equations Calculator Investment Real Estate Property Land Residential Commercial Building Formulas.

This will reduce your basis giving you an adjusted basis of 437000 440000 old adjusted basis minus 3000 cumulative depreciation. Ad Calculate Airbnb Income Potential. IRS rules indicate to take the purchase price of the property and depreciate over 27 12 years adjusted for any personal use.

Regarding basis for depreciation on rental property. Adjusted Cost Basis Purchase price Depreciation. For example a property with an initially assessed value of 225000 is taxed at 1 per year and the assessed value is automatically increased by 2 per year.

3 Ratios To Start Tracking Now Rental Property Calculator Accidental Rental

Rental Property Calculator 2022 Casaplorer

Converting A Residence To Rental Property

How To Use Rental Property Depreciation To Your Advantage

The Four Returns In Real Estate Cash Flow Is Not Everything

Rental Property Calculators That Highly Profitable Landlords Use

How To Calculate Cost Basis For Rental Property

How To Report The Sale Of A U S Rental Property Madan Ca

Rental Property Cost Basis Calculations Youtube

How To Calculate Adjusted Basis Of Rental Property

Free Rental Property Excel Spreadsheet Start Investing In Real Estate

How To Report The Sale Of A U S Rental Property Madan Ca

Guide To Calculating Cost Basis Novel Investor

Rental Property Cash On Cash Return Calculator Invest Four More

Return On Equity Roe Calculator For Real Estate Investing Denver Investment Real Estate

Rental Income Property Analysis Excel Spreadsheet

Rental Property Profit Calculator Watch Quick Video Mortgageblog Com